On January 6, 2026, at 15:30 PM, the special lecture for"The 53rd Frontier Forum on Digital Technology and Economic Finance:Fake Bidders, Real Consequences: Shill Bidding and Price Manipulation in Judicial Housing Auctions"was successfully held in Conference Room 508,South Wenzuan Building.The lecture was delivered by Assistant Professor Rong Hu from Baruch College, City University of New York. It was chaired by Professor Minggui Yu, Dean of the School of Finance at Zhongnan University of Economics and Law and Contact Director of the Innovation and Talent Base for Digital Technology and Finance. Over 30 faculty members and students from the School of Finance attended the lecture offline.

The lecture officially commenced with a brief opening address by Professor Minggui Yu. First, Assistant Professor Rong Hu introduced the research background, noting that “shill bidding” in online judicial auctions is highly concealed and that existing studies lack causal inference regarding its societal impact. This research aims to bridge this gap by identifying and quantifying shill bidding and its consequences in China's judicial housing auctions.

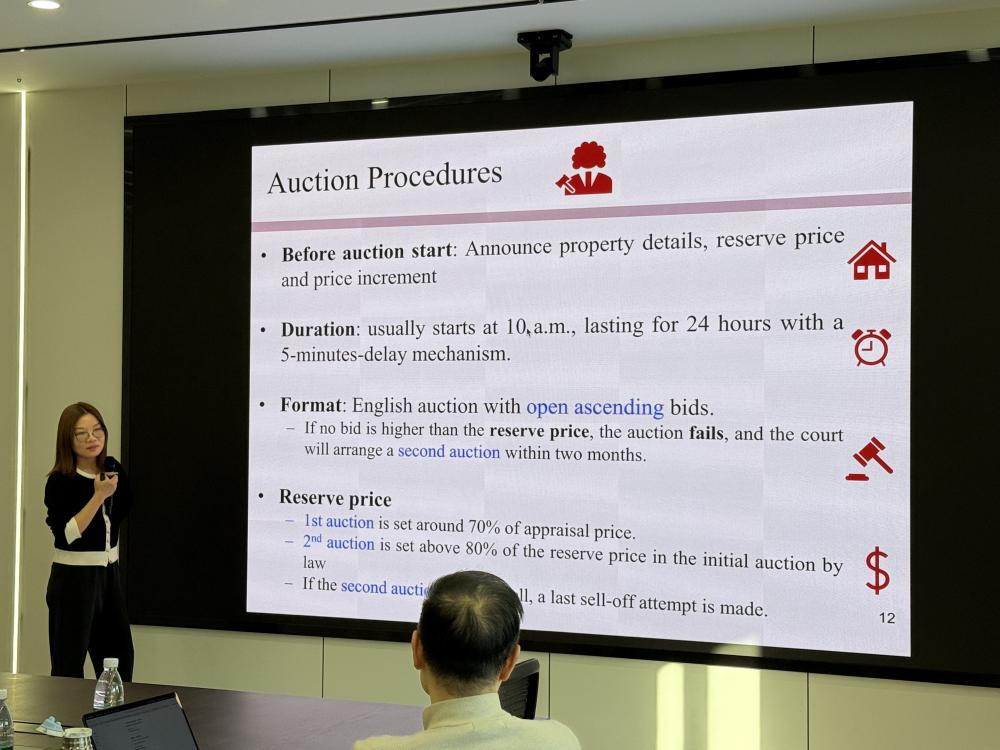

Next, Assistant Professor Rong Hu introduced the data foundation and identification mechanism of the study. The research team utilized comprehensive data from China's online judicial housing auctions from 2015 to 2023, identifying potential shill bidding by tracking abnormal bidding patterns. The study found that although only approximately 8% of judicial housing auctions involved shill bidding, its presence increased the final transaction premium by an average of 14.3%. This result strongly supports the "valuation signaling hypothesis," where fake bids mislead genuine bidders in their judgment of the property's value.

To establish a rigorous causal relationship, the study employed a quasi-experimental research approach. Assistant Professor Rong Hu pointed out that a notice issued by the Jiangsu Provincial High People’s Court in September 2017, which strengthened auction supervision, constituted an external policy shock targeting shill bidding. Analysis using the difference-in-differences method revealed that after the policy was implemented, the premium level in affected auctions significantly decreased by 8.2%, demonstrating that enhanced regulation can effectively curb price manipulation.

Furthermore, the study also revealed heterogeneity in the effects of shill bidding. Assistant Professor Rong Hu presented the key mechanisms: in regions with lower deposit requirements, weaker regulatory oversight, higher social trust, and prevalent online fraud, price distortions caused by shill bidding were more pronounced. Such fraudulent activities not only harm the interests of legitimate bidders but also severely undermine the integrity of judicial auctions.

During the subsequent Q&A session, Assistant Professor Rong Hu engaged in in-depth discussions with the attending faculty and students on issues such as the precise definition of "shill bidding," the long-term effectiveness of policy interventions, and the regulatory responsibilities of judicial auction platforms.

Finally, Professor Minggui Yu expressed gratitude to Assistant Professor Rong Hu for the insightful presentation and emphasized that the identification of auction fraud and the regulation of judicial markets represent a critical frontier in current international research. He noted that future efforts will continue to advance research and collaboration in this field. With that, the lecture thus concluded successfully.

Speaker Introduction

Prof. Maggie Rong Hu is currently an Assistant Professor at Zicklin School of Business, Baruch College. Her primary research interests include real estate finance, household finance, and empirical corporate finance. Her research has been published in leading journals such as American Economic Review, Management Science, Information Systems Research, Journal of Financial and Quantitative Analysis, Review of Finance, and Real Estate Economics. Her papers have received multiple Best Paper Awards at leading international conferences and have won several competitive research grants.

Frontier Forum for Digital Technology and Finance introduction

Recent years have witnessed a dramatic acceleration in a digital revolution in economic sectors and a rapid adoption of the new generation of information technologies, such as artificial intelligence, blockchain, cloud computing, big data, etc. These technologies effectively set off the digital economy. It has become a key driving force in creating global economic growth, improving the modernization level of governance capabilities, and promoting high-quality economic development in China. In particular, digital finance is the most important part of the digital economy. To explore the development direction of the cross-integration of digital technology and finance, the Innovation and Talent Base for Digital Technology and Finance is hosting the “Frontier Forum for Digital Technology and Finance”, in collaboration with the School of Finance, Wenlan School of Business, Economics School, School of Information and Safety Engineering, School of Statistics and Mathematics, School of Public Finance and Taxation of Zhongnan University of Economics and Law (ZUEL). This lecture series will invite the well-known scholars at home and abroad in digital technology, digital economy, digital finance, and other related fields as guest speakers, providing an open and cutting-edge academic exchange platform for interdisciplinary research on digital technology and finance.