On the afternoon of December 29, 2025, at 15:30, the 52nd session of the "Frontier Forum on Digital Technology, Economy, and Finance: Using Aggregate Non-GAAP Earnings to Forecast Future Economic Growth" special lecture was successfully held in Room 508, South WENQUAN Building. The lecture was delivered by Assoc. Prof. Qing Zhou, currently affiliated with Macquarie University, Australia. The session was chaired by Prof. Jing Shi, doctoral supervisor at the School of Finance of Zhongnan University of Economics and Law and chief expert of the Innovation Introduction Base for Digital Technology and Modern Finance Discipline. Over 20 faculty members and students from the School of Finance attended the lecture offline.

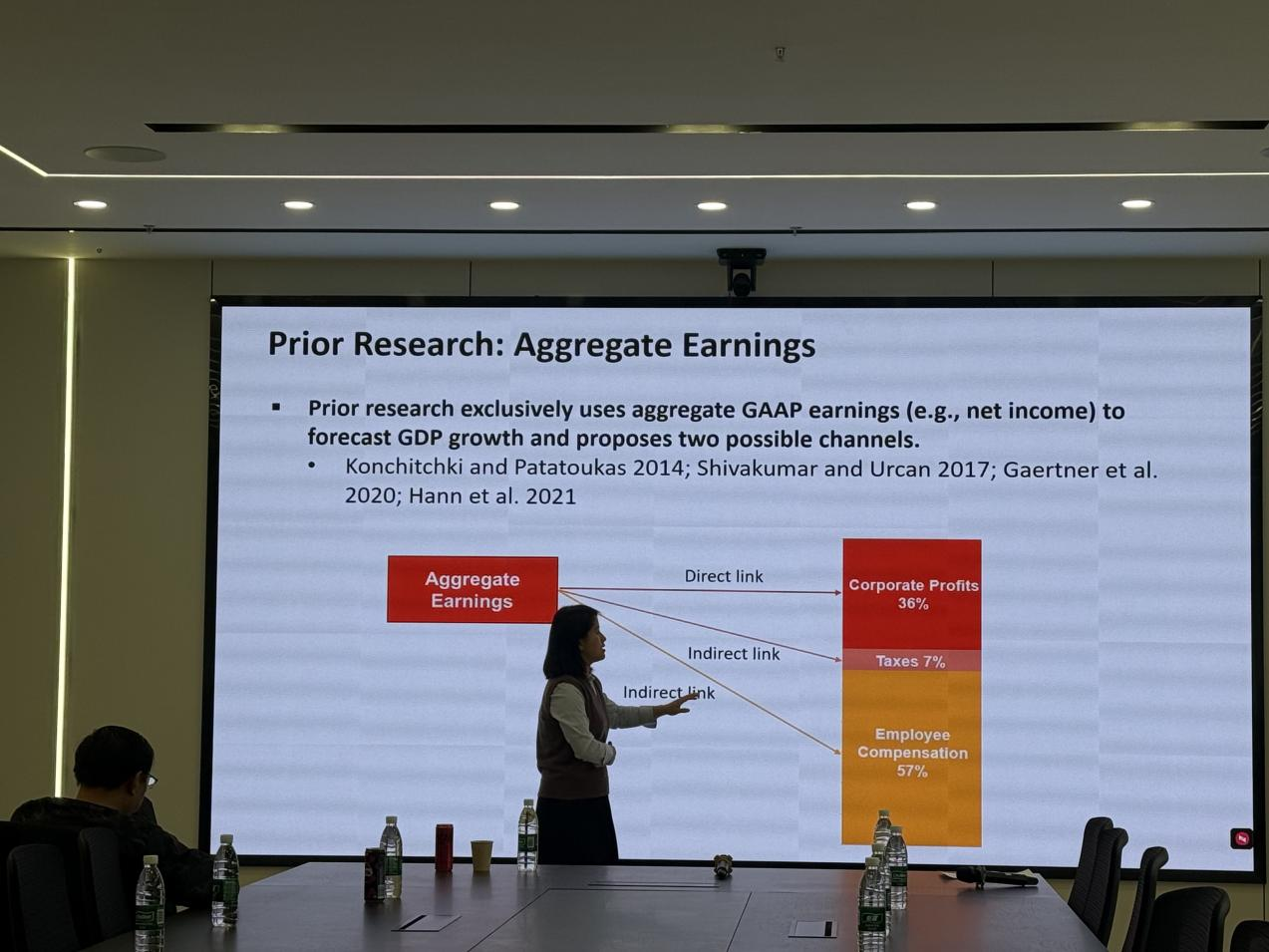

The lecture officially commenced following a brief opening address by Prof. JIN Shi. First, Assoc. Prof. Qing Zhou pointed out that current macroeconomic forecasters have not yet fully exploited the informational value of aggregate non-GAAP earnings. Elevating non-GAAP earnings analysis to the macroeconomic level helps bridge the link between micro-level accounting information and macroeconomic performance, which holds significant research value. This approach can clarify the underlying logic and boundary conditions under which non-GAAP earnings exert predictive effects.

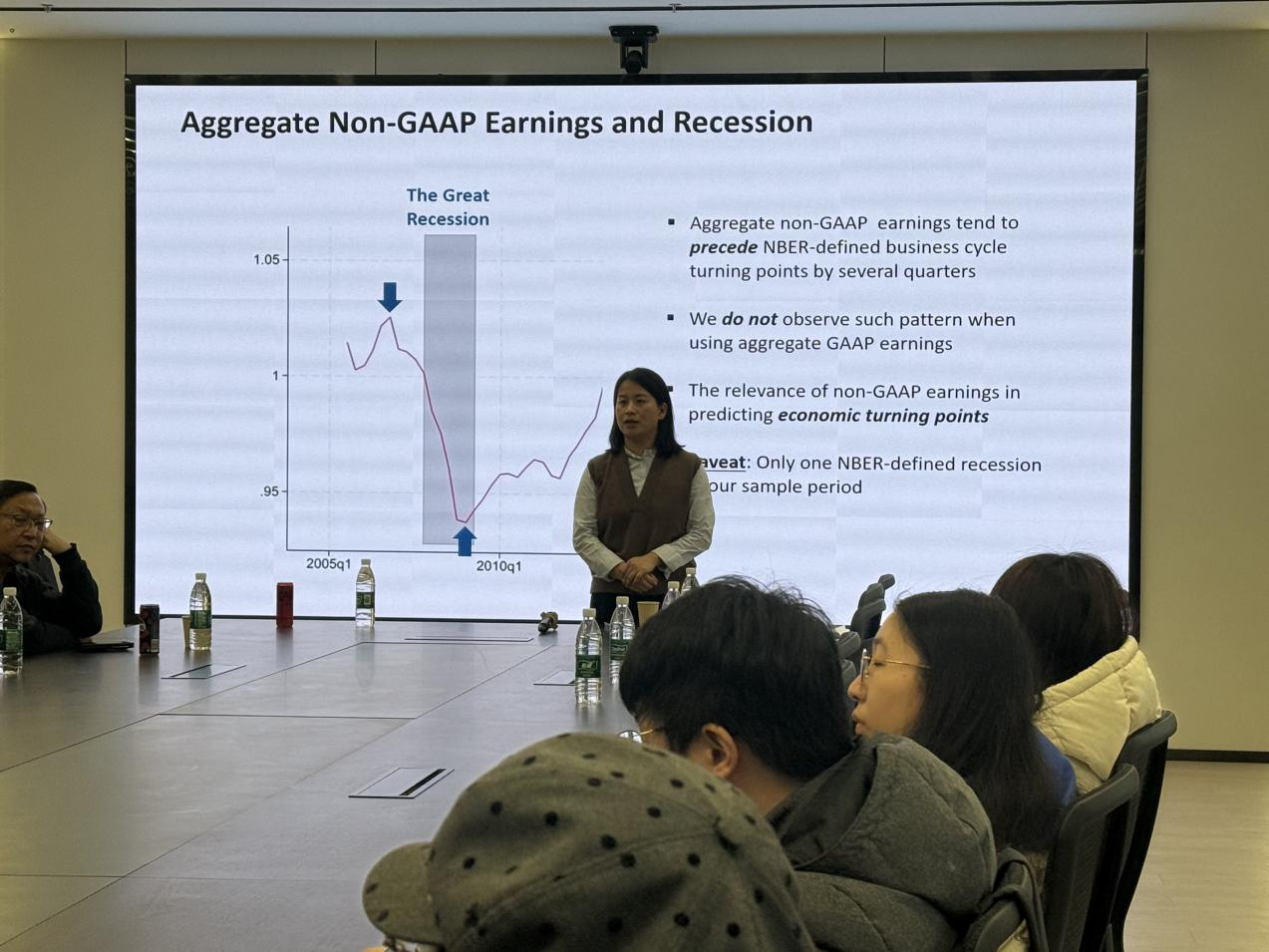

Next, Assoc. Prof. Qing Zhou elaborated in detail on the related research conducted by her team. By constructing an empirical model with historical GDP growth data as the dependent variable and aggregate non-GAAP earnings along with aggregate GAAP earnings as the core explanatory variables, the team conducted a long-term time-series analysis. The study reveals that although aggregate non-GAAP earnings demonstrate superior predictive power for future GDP growth, macroeconomic forecasters have not yet fully explored or utilized the value of this information. Moreover, aggregate non-GAAP earnings exhibit a dual predictive role.

Subsequently, Assoc. Prof. Qing Zhou delved into the internal reasons behind the superior performance of aggregate non-GAAP earnings. She pointed out that, on the one hand, non-GAAP earnings can more accurately reflect a company’s core profitability, while on the other hand, they effectively capture management’s private information regarding the future operations of the firm. To further clarify the underlying logic of why non-GAAP earnings outperform GAAP earnings, Assoc. Prof. Qing Zhou and her team derived key conclusions through time-series decomposition.

During the Q&A session, the attending faculty and students engaged in in-depth discussions on topics such as research methodology, indicator selection, and the practical application of the conclusions. The participants unanimously expressed that this lecture broadened their academic perspectives and deepened their understanding of the connection between accounting information and macroeconomics.

Finally, Prof. JIN Shi expressed his gratitude to Assoc. Prof. Qing Zhou for the insightful sharing and emphasized that the macroeconomic predictive value of non-GAAP earnings is an important direction in financial research, and efforts will continue to promote research and collaboration in this field. With this, the lecture was successfully concluded.

Speaker Introduction

Dr. Qing Zhou is an Associate Professor of Finance and a doctoral supervisor at the Macquarie Business School, Macquarie University, Australia. Her research areas span corporate finance, banking, and climate finance, with a focus on how markets and regulations influence corporate financing and investment decisions. Her research findings have been published in international academic journals such as the Journal of Corporate Finance, Journal of Banking and Finance, Journal of Empirical Finance, and Journal of Business Ethics. Dr. Zhou currently serves as the Postgraduate Course Director in the Department of Applied Finance at Macquarie Business School. She also holds editorial roles as an Associate Editor for Pacific-Basin Finance Journal and Accounting and Finance, and as a Special Issue Editor for British Accounting Review and Global Finance Journal.

Frontier Forum for Digital Technology and Finance introduction

Recent years have witnessed a dramatic acceleration in a digital revolution in economic sectors and a rapid adoption of the new generation of information technologies, such as artificial intelligence, blockchain, cloud computing, big data, etc. These technologies effectively set off the digital economy. It has become a key driving force in creating global economic growth, improving the modernization level of governance capabilities, and promoting high-quality economic development in China. In particular, digital finance is the most important part of the digital economy. To explore the development direction of the cross-integration of digital technology and finance, the Innovation and Talent Base for Digital Technology and Finance is hosting the “Frontier Forum for Digital Technology and Finance”, in collaboration with the School of Finance, Wenlan School of Business, Economics School, School of Information and Safety Engineering, School of Statistics and Mathematics, School of Public Finance and Taxation of Zhongnan University of Economics and Law (ZUEL). This lecture series will invite the well-known scholars at home and abroad in digital technology, digital economy, digital finance, and other related fields as guest speakers, providing an open and cutting-edge academic exchange platform for interdisciplinary research on digital technology and finance.