At 16:00 on December 21, 2022, the 12th Digital Technology and Economic and Financial Frontier Forum hosted by Digital Technology and Modern Finance Discipline Introduction Base was successfully held online. The theme of this forum is "Being Present: Current Economic Conditions and Bond Return ", the guest speaker is Professor Xiaoneng Zhu from the School of Finance, Shanghai University of Finance and Economics. The conference is presided over by Professor Yongbin Lv, Deputy Director of the Innovation and Introduction Base of Digital Technology and Modern Finance and deputy Dean of the School of Finance. Professor Minggui Yu, co-director of the Base and Dean of the School of Finance, Associate Professor Xianming Sun, executive deputy director of the base and Associate Professor of the School of Finance, and teachers and students from universities all over the country attended the forum.

First of all, Professor Zhu explained the research motivation of the article from the perspective of macro expectations. Existing literature emphasizes the importance of long-term trend forecasting of factors such as economic activity and inflation level in bond price forecasting. However, current short-term forecasting cannot be ignored, and the results of long-term and short-term forecasting are often different. So Zhu and his co-authors looked at the impact of investors' short-term expectations of living in the present on bond prices, based on current economic judgments.

This paper puts forward three research objectives: (1) how to integrate macro expectations into bond prices; (2) Whether the information reflected by the long-term and short-term trends is conflicting or complementary; (3) What is the help of short-term expectations to the forecast of interest rates?

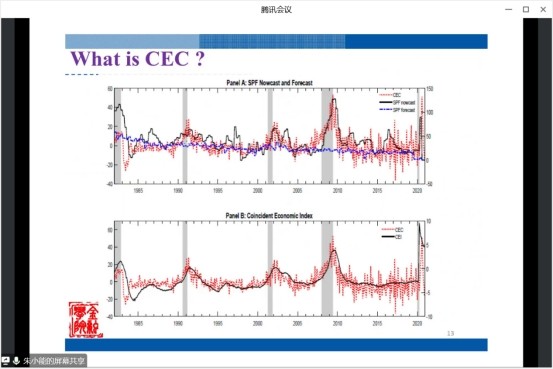

Based on the real-time macroeconomic data available from the Federal Reserve from March 1983 to December 2021, Professor Zhu and his collaborators used the machine learning method to construct the CEC index reflecting the current economic situation, which includes output, employment, orders, housing, money and credit, price and other dimensions of information. Then, incremental R squared is used to investigate the predictive ability of CEC index to bond yields after controlling the long-term economic trend variables. In sample regression results show that CEC index has a significant predictive ability for bond prices, and R squared is significantly improved. For out of sample regression, R squared can also reach the 35% level.

These results suggest that analysis of the current economic situation is of some importance to understanding bond risk premiums, and that investors are largely living in the present. Both long-term and short-term economic situation information are very important to the fluctuation of bond prices, and they have certain complementarity. Taking the current economic situation into account, the countercyclical excess returns of bonds can be better described, and out-of-sample forecasting can be conducted more accurately.

Finally, the teachers and students at the forum asked questions and discussed the content of Professor Zhu's lecture. Professor Lv Yongbin expressed his thanks to Professor Zhu's speech. The forum was successfully concluded.

Speaker Introduction

Xiaoneng Zhu, Professor and doctoral supervisor of the School of Finance, Shanghai University of Finance and Economics. He is also the researcher of the Shanghai Institute of International Finance and Economics. His research interests include asset pricing, financial markets and macroeconomics, finTech, monetary policy, etc. In recent years, He has published more than 30 papers in International authoritative journals such as the Journal of Financial Economics, Management Science, Journal of Financial and Quantitative Analysis, Review of Finance. He also has published more than 10 papers in domestic authoritative journals such as Economic Research, Financial Research, Quarterly Journal of Economics, and Journal of Management Science.

Frontier Forum for Digital Technology and Finance introduction

Recent years have witnessed a dramatic acceleration in a digital revolution in economic sectors and a rapid adoption of the new generation of information technologies, such as artificial intelligence, blockchain, cloud computing, big data, etc. These technologies effectively set off the digital economy. It has become a key driving force in creating global economic growth, improving the modernization level of governance capabilities, and promoting high-quality economic development in China. In particular, digital finance is the most important part of the digital economy. To explore the development direction of the cross-integration of digital technology and finance, the Innovation and Talent Base for Digital Technology and Finance is hosting the “Frontier Forum for Digital Technology and Finance”, in collaboration with the School of Finance, Wenlan School of Business, Economics School, School of Information and Safety Engineering, School of Statistics and Mathematics, School of Public Finance and Taxation of Zhongnan University of Economics and Law (ZUEL). This lecture series will invite the well-known scholars at home and abroad in digital technology, digital economy, digital finance, and other related fields as guest speakers, providing an open and cutting-edge academic exchange platform for interdisciplinary research on digital technology and finance.