At 9:00 a.m. on May 6, 2022, the seventh Frontier Forum for Digital Technology and Finance, jointly sponsored by the Innovation and Talent Base for Digital Technology and Finance, the School of Finance, and the Collaborative Faculties, was successfully held online. Professor Hengjie Ai of the University of Wisconsin-Madison was invited to give a lecture on the theme of "Information-driven volatility". The lecture was presided over by Professor Xianming Sun, Executive Deputy Director of the Base.

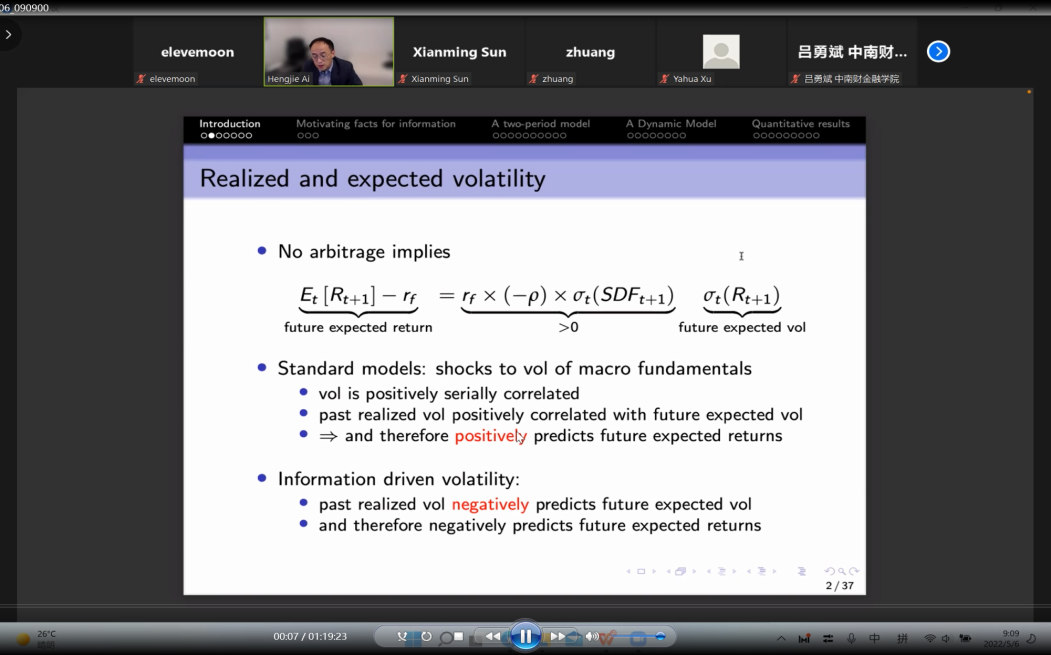

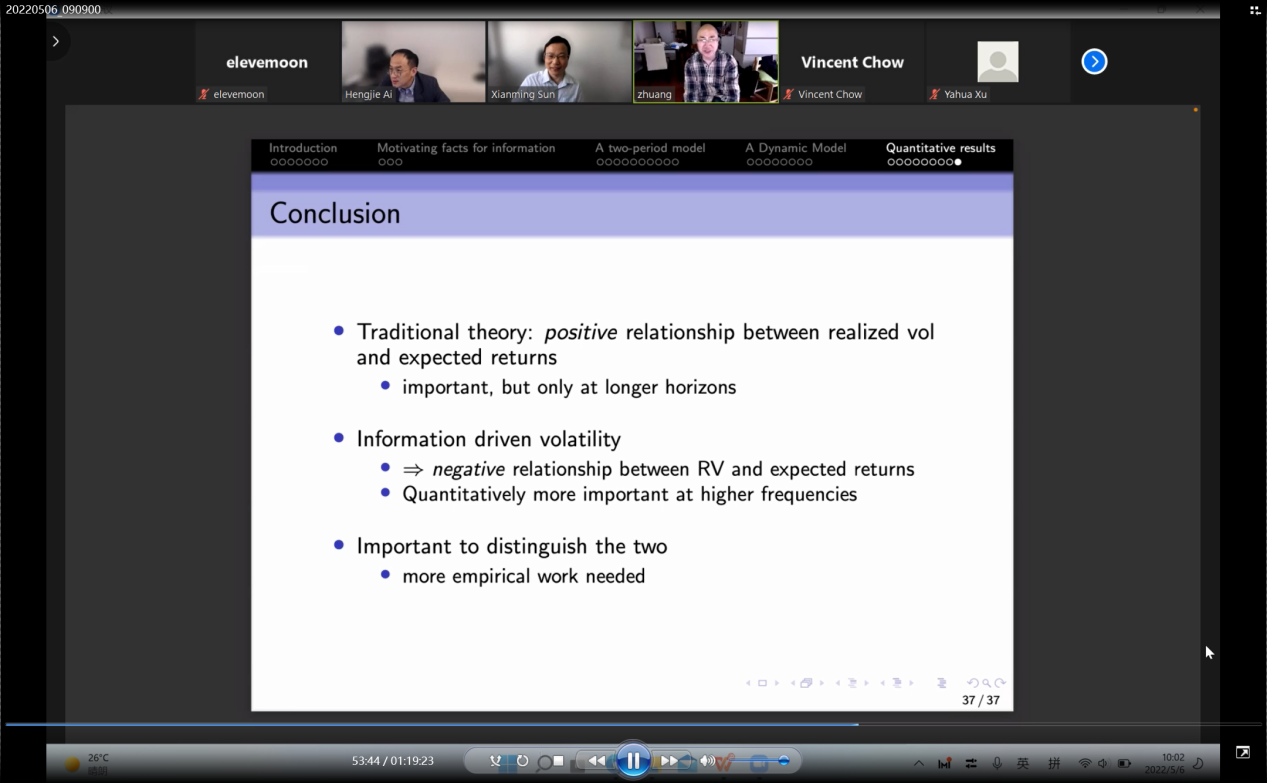

The standard no-arbitrage model states that there is a positive correlation between expected volatility and expected returns. However, empirical experience (dating back to the 1990s) suggests that past realized volatility tends to correlate negatively with expected future returns. In this vein, Professor Ai and his collaborators proposed a theory of information-driven volatility. They contend that when macroeconomics remains constant and market signals are accurate, the market reaction takes away some of the uncertainty, and thus the future volatility decreases. Therefore, information-driven volatility could induce a negative correlation between realized volatility and expected future volatility.

Based on this intuition, Professor Ai and his collaborators built the two-period model and dynamic model to price assets. The results suggest that this information-driven volatility can explain some of the asset pricing paradoxes, such as the returns of volatility managed portfolios, the "variance risk premiums" return predictability (Bollerslev, Tauchen, and Zhou, 2009), and the predictability of returns by implied volatility reduction on macroeconomic announcement days.

After the sharing, Professor Xianming Sun thanked Professor Ai for his wonderful speech and gave a brief summary. Teachers from the School of Finance had an academic discussion with Professor Ai.

Speaker Introduction

Hengjie Ai, Professor of Finance and Robert M. Steiner Chair in Business at the University of Wisconsin-Madison. Prior to joining the Wisconsin School of Business, Professor Ai served as a faculty member in Finance at the Carlson School of Management at the University of Minnesota. Professor Ai's research interests include topics in asset pricing, corporate finance, and macroeconomic theory. His research has been published in top Economics journals such as Econometrica, and top finance journals such as the Journal of Finance, the Journal of Financial Economics, and the Review of Financial Studies.

Frontier Forum for Digital Technology and Finance

Recent years have witnessed a dramatic acceleration in a digital revolution in economic sectors and a rapid adoption of the new generation of information technologies, such as artificial intelligence, blockchain, cloud computing, big data, etc. These technologies effectively set off the digital economy. It has become a key driving force in creating global economic growth, improving the modernization level of governance capabilities, and promoting high-quality economic development in China. In particular, digital finance is the most important part of the digital economy. To explore the development direction of the cross-integration of digital technology and finance, the Innovation and Talent Base for Digital Technology and Finance is hosting the “Frontier Forum for Digital Technology and Finance”, in collaboration with the School of Finance, Wenlan School of Business, Economics School, School of Information and Safety Engineering, School of Statistics and Mathematics, School of Public Finance and Taxation of Zhongnan University of Economics and Law (ZUEL). This lecture series will invite the well-known scholars at home and abroad in digital technology, digital economy, digital finance, and other related fields as guest speakers, providing an open and cutting-edge academic exchange platform for interdisciplinary research on digital technology and finance.