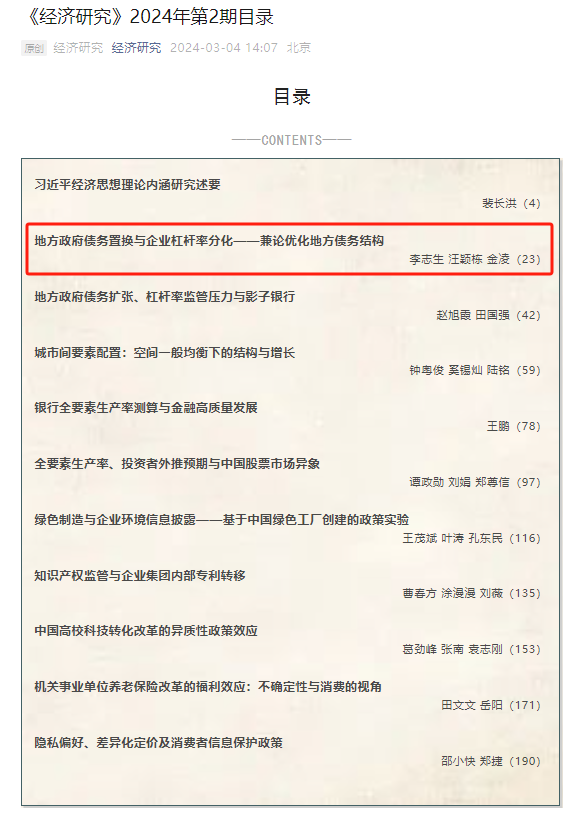

Professor Zhisheng Li, the director of the base, Dr. Yingdong Wang (School of Finance, Zhongnan University of Economics and Law),and Associate Professor Ling Jin (researcher of the base), published a collaborative paper titled "Local Government Debt Replacement and the Divergence of Enterprise Leverage Ratio - with a Discussion on Optimizing Local Debt Structure" in the Issue 2 of Economic Research in 2024.

In 2014, China launched the reform of the local government debt management system, with debt replacement playing a very important role. Judging from the course and effectiveness of the three rounds of debt replacement, debt replacement has swapped a large amount of off-balance-sheet debt into local government bonds, optimized the structure of local government debt, strengthened the coverage of financial regulation on local government debt, and become an important component of China's current and future comprehensive debt solutions.

This article takes the debt replacement plan launched in 2014-2015 as the research object to explore the impact of the optimization of local government debt structure on the leverage ratio differentiation between state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs). The study found that the debt replacement plan significantly increased the leverage ratio of non-SOEs relative to SOEs, thus alleviating the leverage ratio differentiation between the two. Heterogeneity analysis showed that the governance effect of debt replacement on leverage ratio differentiation was mainly manifested in enterprises with low financialization and small and medium-sized enterprises, which helped to improve the ability of financial services to serve the real economy and the efficiency of credit resource allocation. Debt replacement could also weaken the negative impact accompanying fiscal decentralization, and the marketization of credit allocation was an important condition for its governance effect on leverage ratio differentiation. Debt replacement could alleviate the crowding-out effect of local government debt on non-SOE financing, increase bank credit supply, and reduce implicit guarantee expectations, providing a good environment for non-SOE financing and optimizing the allocation of debt resources between SOEs and non-SOEs. In addition, debt replacement also improved the investment efficiency of non-SOEs while reducing the debt risks of SOEs.

Based on the basic fact of leverage ratio differentiation among China's real enterprises, this article explores the impact of debt replacement on the allocation of debt resources among different types of enterprises, which helps us comprehensively understand the economic effects of debt replacement and the optimization of local government debt structure. The research in this article has clear policy implications. Debt replacement not only extends the debt term but also significantly reduces the interest burden, which helps to alleviate the repayment pressure of local government debt due to its maturity concentration and coordinates the resolution of local debt risks with stable development. Considering the competitive relationship between government debt and corporate debt, the optimization of local government debt structure can effectively alleviate the structural imbalance in the allocation of debt resources between state-owned enterprises and non-state-owned enterprises, and is conducive to improving the efficiency of the real economy. In the process of promoting the reform of the local government debt management system, it is necessary to attach great importance to market-oriented and comprehensive supervision of local debt throughout the entire process, continuously optimize the structure of local debt, alleviate structural issues in credit resource allocation, and support the high-quality development of the real economy.

Author profile

Zhisheng Li, Vice President and Professor of Southwestern University of Finance and Economics, Director of the Innovation and Talent Base for Digital Technology and Finance.He specializes in financial innovation, financial risk management, market microstructure, and regional financial development. Professor Li has presided over multiple projects funded by the Program for Innovation and Introduction of Talents in Universities, the National Social Science Fund, and the National Natural Science Foundation of China. His research has been published in journals such as Economic Research, China Economic Quarterly, Journal of Financial Research, Journal of Banking and Finance, and Journal of Financial Markets.

Professor Li has received numerous awards, including the Second Prize of the National Teaching Achievement Award for Higher Education, Special First Prize of the Hubei Provincial Higher Education Teaching Achievement Award, First Prize of the Sichuan Provincial Higher Education Teaching Achievement Award, First Prize of the Hubei Provincial Outstanding Social Science Achievement Award, and First Prize of the Hubei Provincial Decision Support Work Outstanding Achievement Award. He has also been recognized as a member of the Youth Talents Project of the National Talents Program, the New Century Excellent Talents Program of the Ministry of Education, and the Hubei Provincial Postdoctoral Outstanding Talents Tracking and Training Program. Additionally, he has received the Huo Yingdong Award for Outstanding Young Teachers in Colleges and Universities and the title of Hubei Famous Teacher. Professor Li currently serves as a member of the National Postgraduate Education Steering Committee for Financial Disciplines, Vice President of the Hubei Provincial Finance Association, and Executive Deputy Director of the Hubei Provincial Association for Modernization of Technical and Economic Management.

Yingdong Wang, Doctoral Candidate, School of Finance, Zhongnan University of Economics and Law.

Ling Jin is an associate professor at the School of Finance, Zhongnan University of Economics and Law. She holds a Ph.D. in Economics and is a researcher at the Innovation and Talent Base for Digital Technology and Finance. Her research focuses on financial development, financial innovation, and financial crisis management. She has published numerous papers in journals such as Economic Research, China Economic Quarterly, Journal of Management Sciences in China, Journal of Financial Research, Journal of Financial Markets, and Pacific-Basin Finance Journal. She has presided over the general project of the Postdoctoral Science Foundation and participated in multiple major projects funded by the National Social Science Fund. Her paper was awarded the Excellent Paper Award of Journal of Financial Research in 2021.