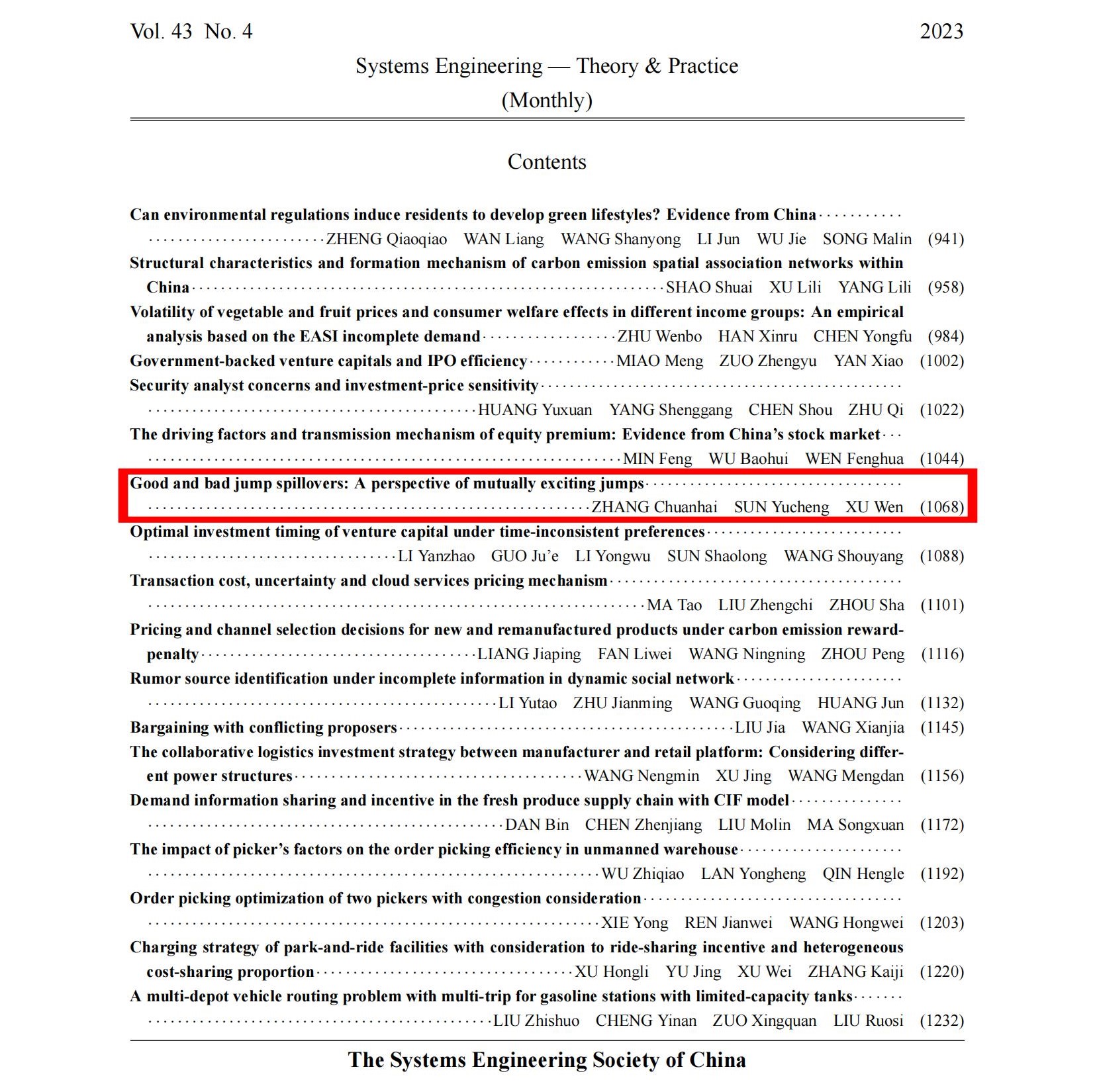

Associate Professor Chuanhai Zhang, a researcher of the base, has published a collaborative paper titled "Good and bad jump spillovers: A perspective of mutually exciting jumps" in the Systems Engineering — Theory & Practice.

Abstract:

Using the CSI 300 index futures and spot markets as an example, this paper investigates the structure and dynamics of good (positive) and bad (negative) jump spillovers between financial markets from the perspective of mutually exciting jumps. First, we find that jump spillovers are asymmetric, and bad jump spillovers, on average, are stronger than good jump spillovers. Second, jump spillovers differ in bear and bull markets, bad jump spillovers are more evident than good jump spillovers in bear markets while good jump spillovers are more evident than bad jump spillovers in bull markets, however, these conclusions do not survive in some bull and bear markets. Third, we also document intraday aftershock effects of jump spillovers, especially for bad jump spillovers. Overall, we document bidirectional jump spillovers between the two markets and jump spillovers vary over time. For example, during the period of tightened trading rules on CSI 300 index futures, jump spillovers from the futures market to the spot market weakened, while the jump spillovers from the spot market to the futures market strengthened.

Keywords: jump spillovers; asymmetry; mutually exciting jumps; aftershock effect; index futures; high frequency data

Link: https://sysengi.cjoe.ac.cn/CN/10.12011/SETP2021-2001

Teacher profile

Zhang Chuanhai, PhD, Associate Professor, School of Finance, Zhongnan University of Economics and Law. His research interests include financial markets, financial measurement and financial risk, as well as Fintech and big data. His research papers have been published in: Economic Research, Systems Engineering Theory and Practice, Journal of Management Engineering, Mathematical Statistics and Management, Journal of Econometrics, Quantitative Finance, Pacific-Basin Finance Journal, Finance Research Letters, International Review of Financial Analysis and Economic Modelling and other domestic and foreign journals.