On May 9, 2025, at 14:00 pm, the 41st Forum on Digital Technology and Economic Finance Frontiers was successfully held. The theme of this lecture was "Robust valuation and optimal harvesting of forestry resources in the presence of catastrophe risk and parameter uncertainty", and the guest speaker was Dr. Yihan Zou from the University of Glasgow. The lecture was chaired by Xiangyu Zong, Lecturer of the Finance School and researcher at the Innovation and Talent Base for Digital Technology and Finance. More than 30 teachers and students from the School of Finance participated in this lecture.

At the beginning of the lecture, Lecturer Xiangyu Zong briefly introduced relevant information of Dr. Yihan Zou to the participants and expressed his sincere gratitude for his availability to give a lecture at our college despite his busy schedule.

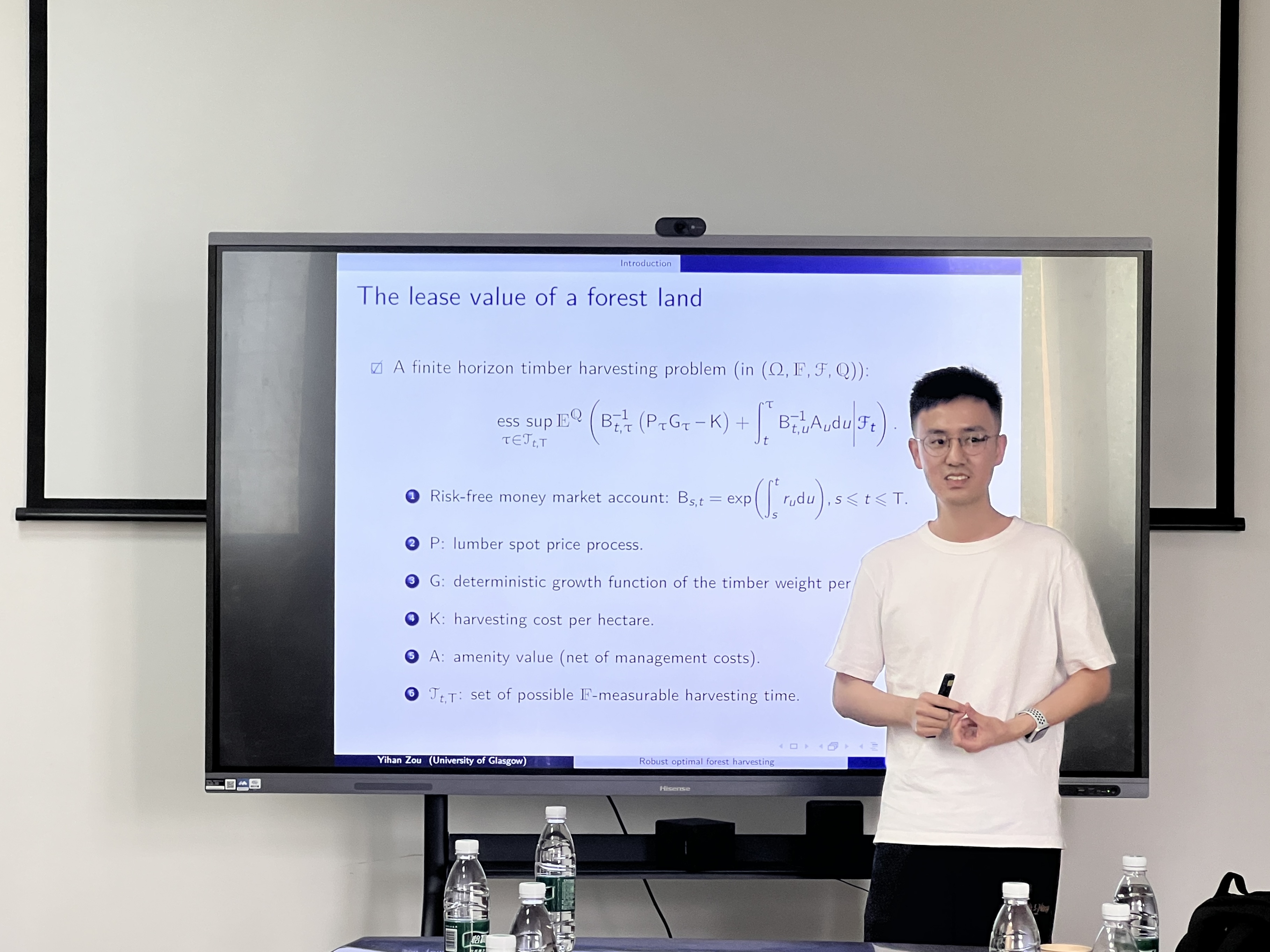

Dr. Yihan Zou began by highlighting the systemic revaluation of forestry resources’ economic and ecological roles amid the global energy transition. He noted that increasing climate disasters (e.g., wildfires) and timber price volatility pose new challenges to long-term forest asset valuation and sustainable management. To address this, Dr. Yihan Zou innovatively developed an analytical framework integrating catastrophe risk and parameter uncertainty. This framework employs a Poisson process to simulate disaster occurrences, a two-factor stochastic convenience yield model to capture timber price dynamics, and parameter calibration based on U.S. wildfire data and timber futures market information.

A key breakthrough of the study lies in its systematic revelation of parameter uncertainty’s implicit impact on forest lease values. Using numerical methods for reflected backward stochastic differential equations (RBSDEs), Dr. Yihan Zou quantified lease values under catastrophe risk and parameter uncertainty. He further established conservative/optimistic boundaries for lease values and optimal harvesting stopping boundaries, offering investors a decision-making toolkit for uncertainty management.

Drawing on numerical experiments, Dr. Yihan Zou emphasized the decisive role of convenience yield—a critical indicator of market supply-demand dynamics—in harvest timing. He also demonstrated that monetized valuation of carbon sinks significantly enhances the long-term holding value of forest assets. Notably, conservative strategies involving delayed harvesting can hedge risks under escalating disaster intensities.

Dr. Yihan Zou concluded by underscoring the study’s methodological contributions to natural resource pricing in green finance. Its “worst-case scenario prioritization” approach provides robust insights for financial institutions designing climate-adaptive products. The event concluded with an interactive Q&A session, where Dr. Yihan Zou addressed questions on carbon market-timber price linkage mechanisms. Attendees praised the lecture for its depth and relevance, marking a successful conclusion to the forum.

Speaker Introduction

Yihan Zou, Ph.D. in Quantitative Finance from the University of Glasgow, is currently affiliated with the School of Economics at the University of Glasgow. He previously taught at Southwestern University of Finance and Economics (SWUFE). His current research interests include derivatives, commodity futures, continuous-time finance, model ambiguity, and numerical analysis/methods for backward stochastic differential equations (BSDEs).

Frontier Forum for Digital Technology and Finance introduction

Recent years have witnessed a dramatic acceleration in a digital revolution in economic sectors and a rapid adoption of the new generation of information technologies, such as artificial intelligence, blockchain, cloud computing, big data, etc. These technologies effectively set off the digital economy. It has become a key driving force in creating global economic growth, improving the modernization level of governance capabilities, and promoting high-quality economic development in China. In particular, digital finance is the most important part of the digital economy. To explore the development direction of the cross-integration of digital technology and finance, the Innovation and Talent Base for Digital Technology and Finance is hosting the “Frontier Forum for Digital Technology and Finance”, in collaboration with the School of Finance, Wenlan School of Business, Economics School, School of Information and Safety Engineering, School of Statistics and Mathematics, School of Public Finance and Taxation of Zhongnan University of Economics and Law (ZUEL). This lecture series will invite the well-known scholars at home and abroad in digital technology, digital economy, digital finance, and other related fields as guest speakers, providing an open and cutting-edge academic exchange platform for interdisciplinary research on digital technology and finance.