The 41st Frontier Forum for Digital Technology and Finance

Topic: | Robust valuation and optimal harvesting of forestry resources in the presence of catastrophe risk and parameter uncertainty |

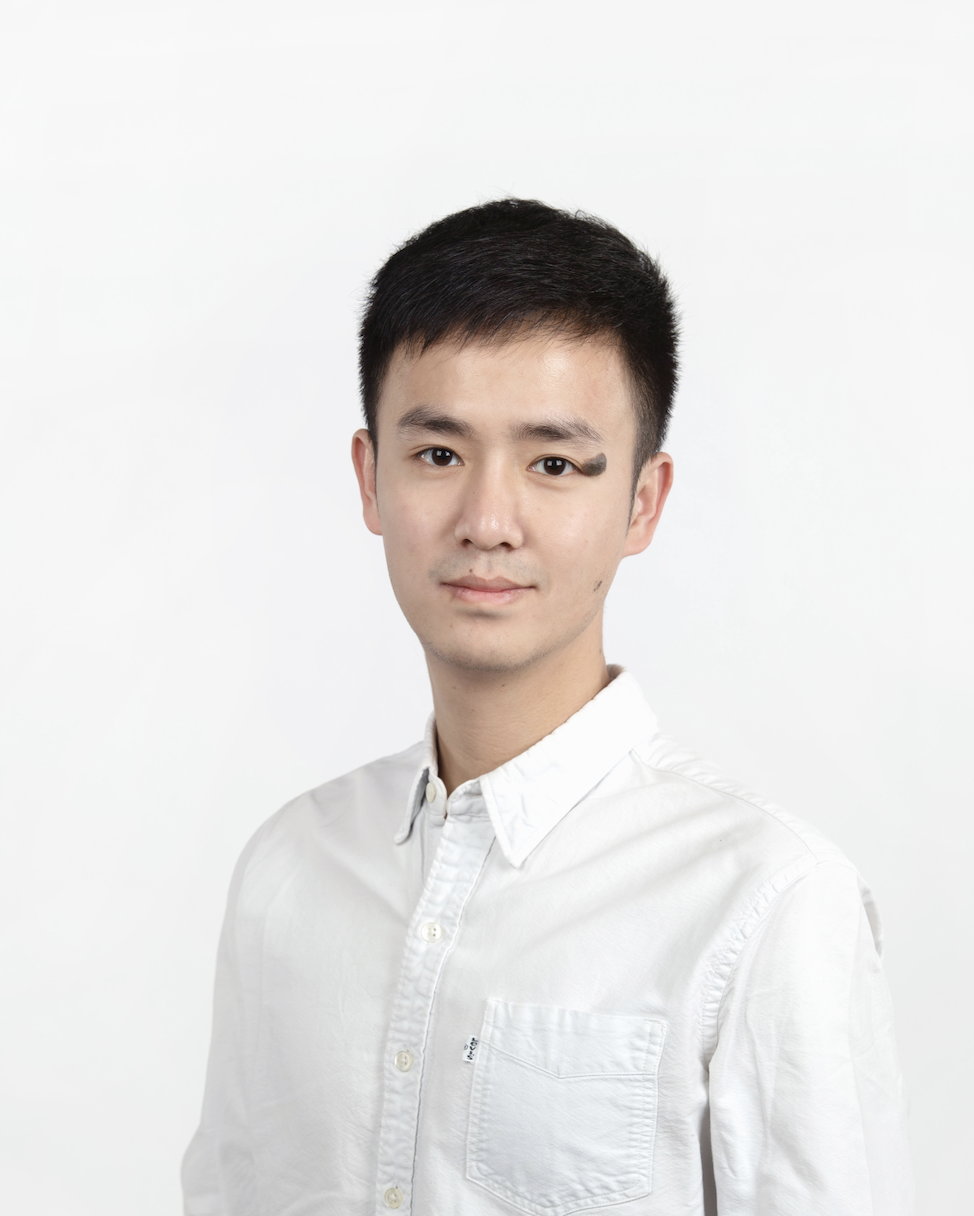

Speaker: | Yihan Zou, Professor University of Glasgow |

Host: | Sichong Chen, Professor School of Finance, Zhongnan University of Economics and Law Innovation and Talent Base for Digital Technology and Finance |

Time: | 14:00-16:00, May, Friday 9, 2025 |

Location: | South 408 Conference Room , Wenquan Building, ZUEL |

Abstract:

We determine forest lease value and optimal harvesting strategies under model parameter uncertainty within stochastic bio-economic models that account for catastrophe risk. Catastrophic events are modeled as a Poisson point process, with a two-factor stochastic convenience yield model capturing the lumber spot price dynamics. Using lumber futures and US wildfire data, we estimate model parameters through a Kalman filter and maximum likelihood estimation and define the model parameter uncertainty set as the 95\% confidence region. We numerically determine the forest lease value under catastrophe risk and parameter uncertainty using reflected backward stochastic differential equations (RBSDEs) and establish conservative and optimistic bounds for lease values and optimal stopping boundaries for harvesting, facilitating Monte Carlo simulations. Numerical experiments further explore how parameter uncertainty, catastrophe intensity, and carbon sequestration impact the lease valuation and harvesting decision. In particular, we explore the costs arising from this form of uncertainty in the form of a reduction of the lease value. These are implicit costs that can be attributed to climate risk and will be emphasized through the importance of forestry resources in the energy transition process. We conclude that in the presence of parameter uncertainty, it is better to lean toward a conservative strategy reflecting, to some extent, the worst case than being overly optimistic. Our results also highlight the critical role of convenience yield in determining optimal harvesting strategies.

Speaker Introduction:

Yihan Zou, Ph.D. in Quantitative Finance from the University of Glasgow, is currently affiliated with the School of Economics at the University of Glasgow. He previously taught at Southwestern University of Finance and Economics (SWUFE). His current research interests include derivatives, commodity futures, continuous-time finance, model ambiguity, and numerical analysis/methods for backward stochastic differential equations (BSDEs).