From November 28-30 and December 5-7, 2022, Digital Technology and Modern Finance Innovation and Introduction Base (Finance 111 Base) invited Professor Hening Liu from University of Manchester to offer a short course on asset pricing. The course opened online at 16:30 on November 28. Professor Minggui Yu, Dean of School of Finance and co-director of Finance 111 Base, Zhongnan University of Economics and Law, delivered a speech. On behalf of the College and the base, Dean Yu Minggui thanked Professor Liu Hening for his support to the construction of the finance discipline of our university and introduced Professor Liu's scientific research achievements and academic experience to everyone. This course has attracted wide attention in the academic circle, attracting more than 100 students and teachers from Tsinghua University, Wuhan University, Sun Yat-sen University, Central University of Finance and Economics, University of International Business and Economics and other universities to attend.

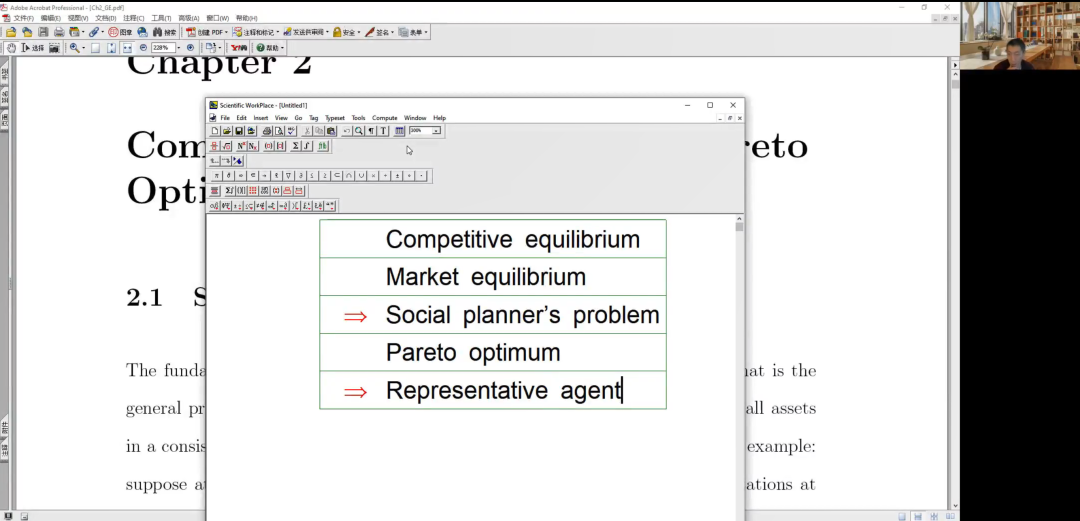

There are six sessions in this course. Prof. Liu Hening wrote "Mean-variance theory and empirical tests of the CAPM", "Competitive equilibrium and Pareto optimum", "Consumption-based asset pricing", "Advanced consumption-based models", "Production-based asset pricing", The title of "Advanced asset pricing theory" explains the theoretical framework and basic logic of asset pricing in a simple way, describes the derivation process of relevant important theories in detail, and fully introduces the frontier theory of asset pricing.

In the course of teaching, the students listened carefully throughout the online, and actively participated in the questions and answers during the discussion, with a high enthusiasm for learning. Professor Liu answered the students' questions in a detailed and illustrated way. Regarding the questions of "Zero-Beta asset portfolio", "risk premium", "recursive utility" and so on, the students had in-depth discussions with Professor Liu. The students all said that they liked Professor Liu's teaching method very much and benefited a lot from it.

Finally, Professor Liu gave a comprehensive summary of this short course. The students expressed their gratitude to Professor Liu for his careful teaching.

Teacher Profile

Hening Liu is a Professor of Finance at Alliance Manchester Business School (AMBS). Hening joined AMBS as a lecturer after completing a PhD in Economics at Northern Illinois University in 2008 and became a Reader in Finance in 2015 and then Professor of Finance in 2017. His research interests include theoretical and empirical asset pricing, financial econometrics and portfolio choice. His recent research has focused on the role of ambiguity preferences in asset pricing, structural estimation of asset pricing models, and general equilibrium models with nonstandard utility preferences.

Hening's research has been published in leading economics and finance journals including the Review of Financial Studies, Journal of Monetary Economics, Journal of Econometrics, Journal of Financial and Quantitative Analysis, Management Science. He also presented his work in leading international conferences including Western Finance Association (WFA) and European Finance Association (EFA) meetings and China International Conference in Finance (CICF). Hening regularly serves as a reviewer for economics and finance journals including American Economic Review, Journal of Financial and Quantitative Analysis, Journal of Political Economy, Management Science, Review of Financial Studies, Journal of Banking and Finance, Journal of Economic Dynamics and Control, among others.